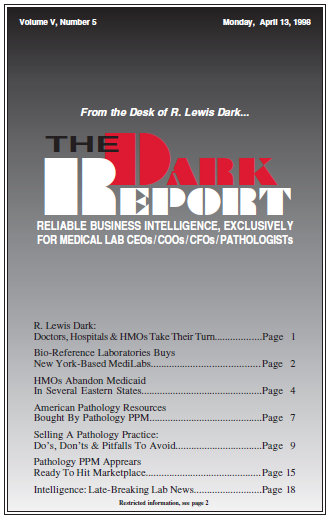

CEO SUMMARY: Physician practice management (PPM) companies represent a powerful new economic trend. Greater numbers of pathologists will soon confront a career-changing decision: should we sell our pathology practice to a PPM? Regardless of how pathologists answer that question, their business will not stay the same. This second installment of our special series addresses the …

Selling A Pathology Practice: Do’s, Don’ts & Pitfalls To Avoid Read More »

To access this post, you must purchase The Dark Report.