CEO SUMMARY: Few pathologists realize how much impact AmeriPath’s business activities will have upon the profession of pathology. Regardless of AmeriPath’s ultimate success or failure, it will bring about irrevocable change to the pathology industry. As the harbinger of such change, AmeriPath will receive more criticism than is their due. UNTIL NOW, most pathologists survived …

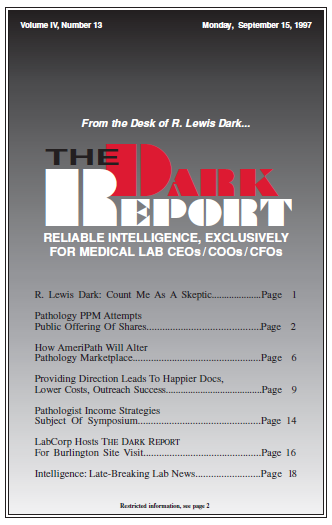

How AmeriPath Will Alter Pathology Marketplace Read More »

To access this post, you must purchase The Dark Report.