CEO SUMMARY: Three new business strategies are moving ChromaVision into different segments of the laboratory testing marketplace. The company has built a new laboratory facility and will support local pathology groups with advanced diagnostic technology. It is also expanding its presence in the research and development area of pharmacodiagnostics, with an emphasis on oncology. PROFIT …

ChromaVision Targets National AP Market Read More »

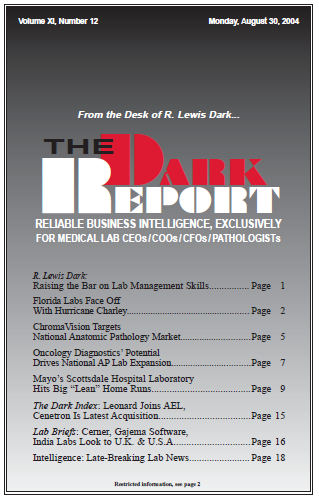

To access this post, you must purchase The Dark Report.