CEO SUMMARY: It is no coincidence that another public company is shifting its business focus and expanding its efforts to capture cancer-related anatomic pathology specimens. Demographic trends predict a steady increase in the number of new cancer cases yearly, while new technologies are giving physicians more effective ways to detect cancer and treat it. That …

Oncology’s Potential Drives AP Lab Expansion Read More »

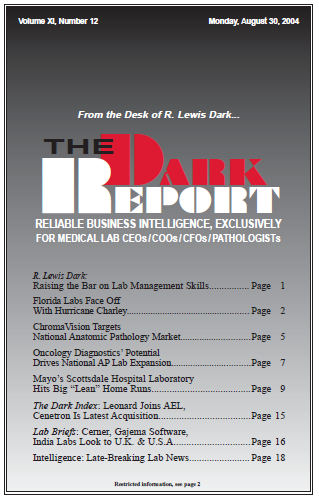

To access this post, you must purchase The Dark Report.