CEO SUMMARY: Over the past 18 months, more specialist groups have created their own anatomic pathology laboratories than were created in the past five years. It’s a gold rush to tap and capture profits generated by the anatomic pathology services provided to their patient populations. This heightened interest in operating in-house anatomic pathology laboratories is …

Changing Economics Motivate Urologists & GIs Read More »

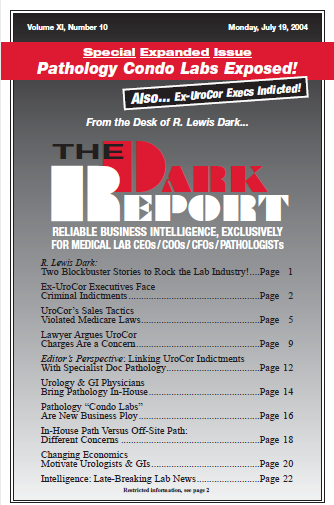

To access this post, you must purchase The Dark Report.