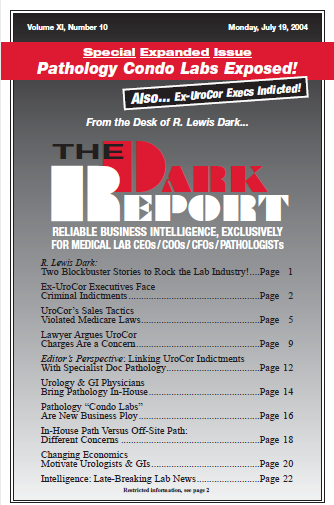

CEO SUMMARY: Criminal charges filed against ex-UroCor executives center around several marketing practices that have much in common with marketing strategies used by many lab- oratories today. These include discounted pricing for non-Medicare specimens, offering to waive charges to payers and patients where UroCor was an “out-of-network” provider, and offering “consulting services” payments to client …

Ex-UroCor Execs Face Criminal Indictments Read More »

To access this post, you must purchase The Dark Report.