CEO SUMMARY: Unlike the slack employment market for pathologists seen during the 1990s, there is strong demand for pathologists in this decade. Private pathology group practices now face competition for the best pathology talent. That’s because public lab companies are regularly in the marketplace looking to hire pathologists with the right subspecialty skills and expertise. …

Market Demand for Pathologists Shifts Toward Specialization Read More »

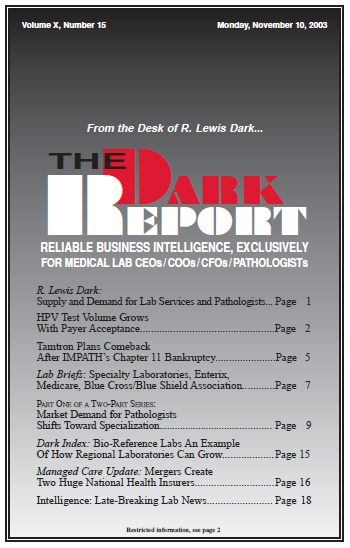

To access this post, you must purchase The Dark Report.