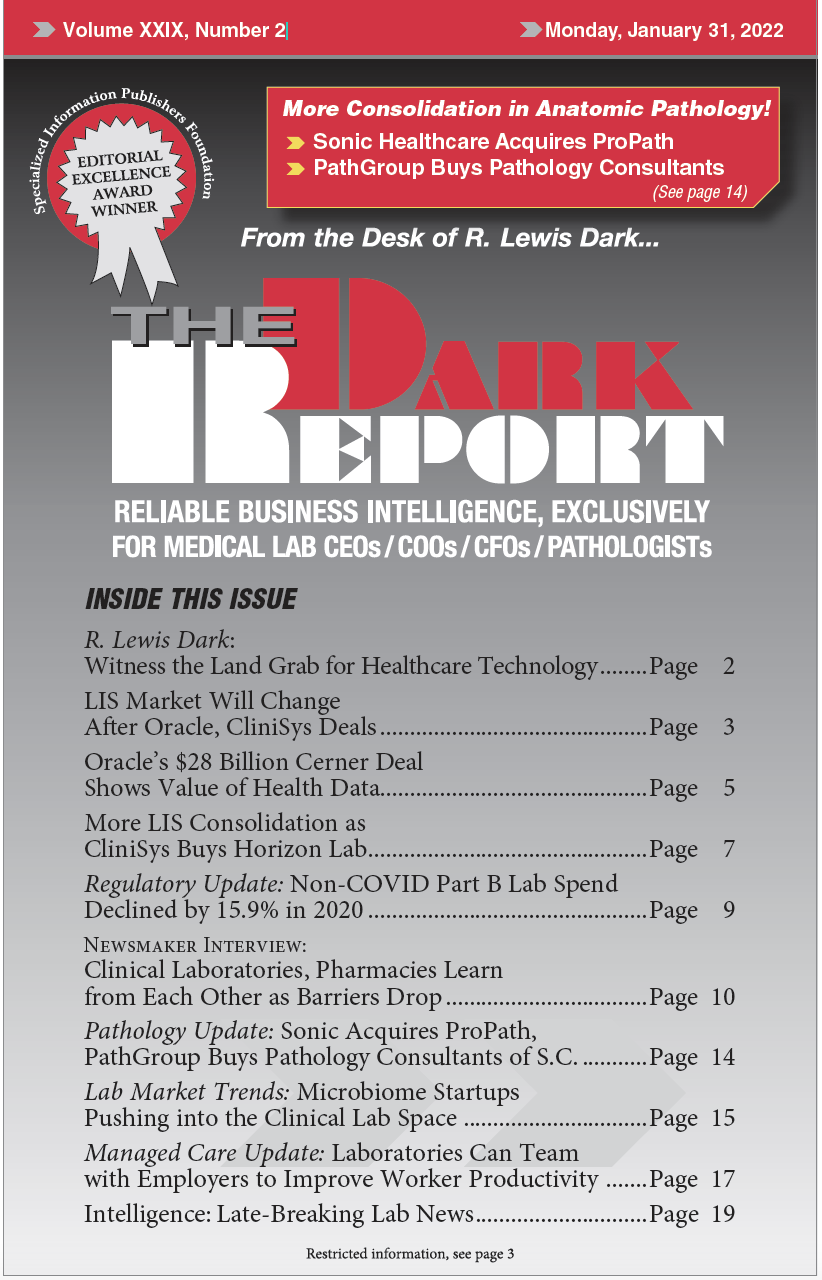

CEO SUMMARY: For three decades, pathologists and clinical lab executives regularly pointed out that clinical laboratory data was extremely valuable. But it seemed nothing changed, no one listened, and labs could not monetize their lab data. Now, one of Silicon Valley’s bigger players in information technology is investing $28 billion to acquire one of the …

Oracle’s $28b Cerner Deal Shows Value of Health Data Read More »

To access this post, you must purchase The Dark Report.