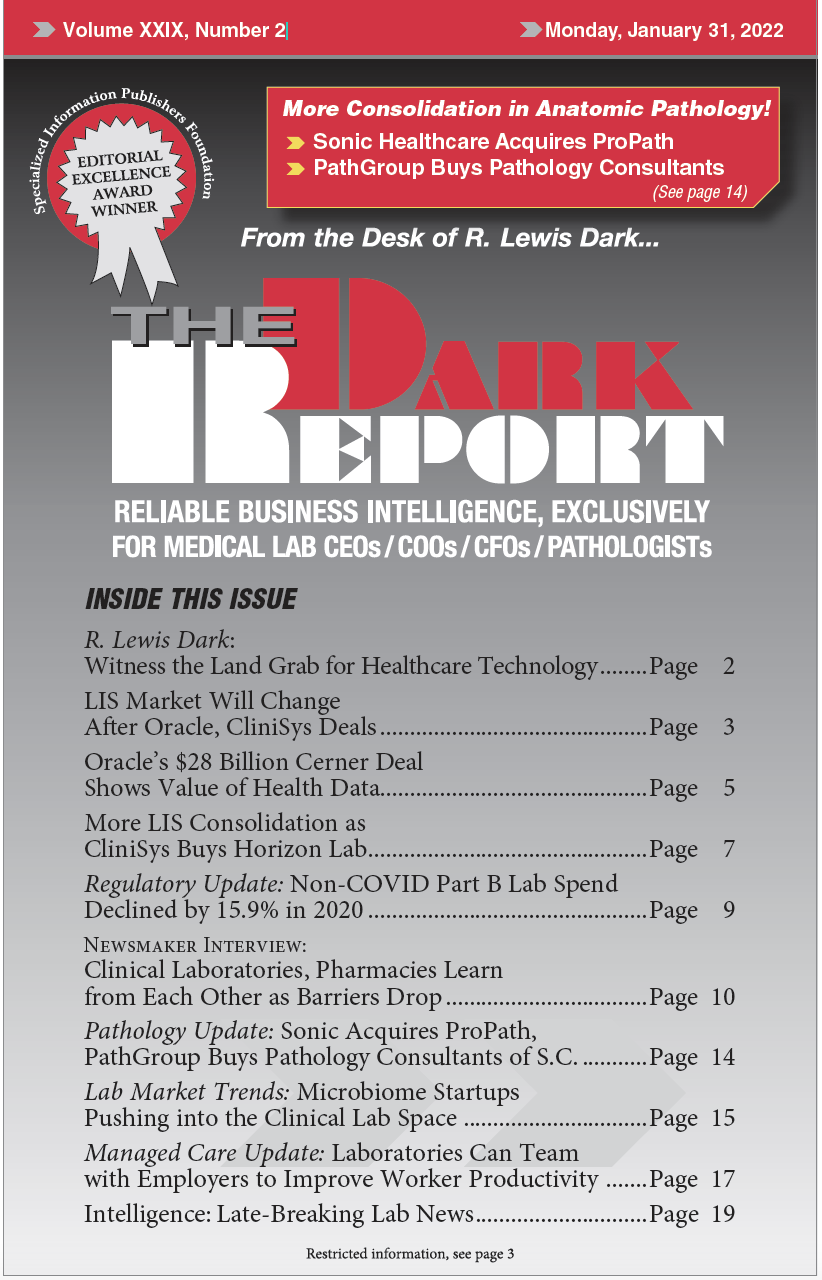

CEO SUMMARY: With its purchase of Cerner Corporation, Oracle becomes the owner of Cerner’s Millennium laboratory information system (LIS) and CoPathPlus, Cerner’s anatomic pathology LIS. Only three weeks later, CliniSys, a division of Roper Technologies, announced it was acquiring Horizon Lab Systems and would combine the Horizon LIS with its Sunquest Information Systems’ LIS. IN […]

To access this post, you must purchase The Dark Report.