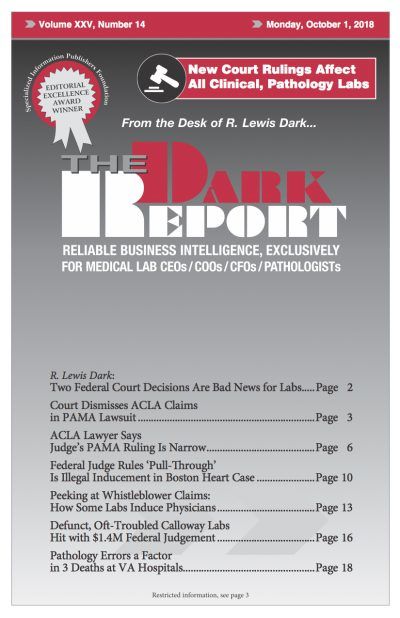

HOW OFTEN IS A DEFUNCT LAB COMPANY IN THE NEWS? That was the odd development last week when it was announced that a U.S. District Court had entered a $1.4 million civil judgement against Calloway Laboratories, Inc., a toxicology lab company formerly based in Woburn, Mass., for business practices during the period May 2014 through …

Defunct, Oft-Troubled Calloway Labs Hit with $1.4M Federal Judgement Read More »

To access this post, you must purchase The Dark Report.