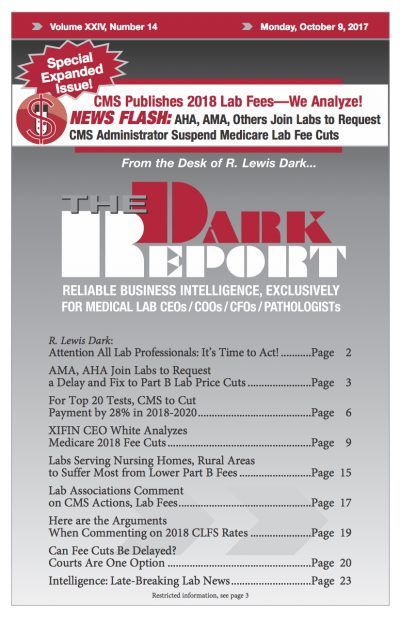

ON SEPT. 22, MEDICARE OFFICIALS RELEASED THE DRAFT PRICES for the 2018 Clinical Laboratory Fee Schedule. The bad news for the lab industry is that the fee cuts are deeper than the federal Centers for Medicare and Medicaid Services had predicted earlier. The price cuts to clinical laboratory test fees will total $670 million in …

For Top 20 Tests, CMS to Cut Payment by 28% in 2018-2020 Read More »

To access this post, you must purchase The Dark Report.