CEO SUMMARY: In just 15 months, Siemens AG has pulled out its checkbook three times to spend more than $14 billion to acquire major in vitro diagnostics (IVD) companies. When it closes the purchase of Dade Behring, Siemens will be in the first rank of global IVD manufacturers. It has also declared that it is …

Siemens Acquires Dade, Builds IVD Powerhouse Read More »

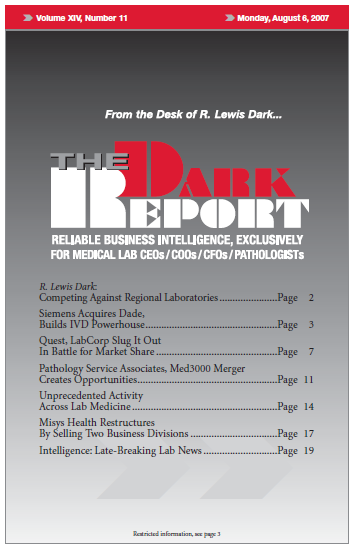

To access this post, you must purchase The Dark Report.