CEO SUMMARY: During the 1990s, Unilab used the twin strategies of lab acquisitions and aggressive sales and marketing to fuel rapid growth in specimen volumes and net revenues. However, California’s ultra-competitive managed care market and severe financial problems during the latter half of the decade almost sunk the laboratory. Today’s Unilab is a more experienced …

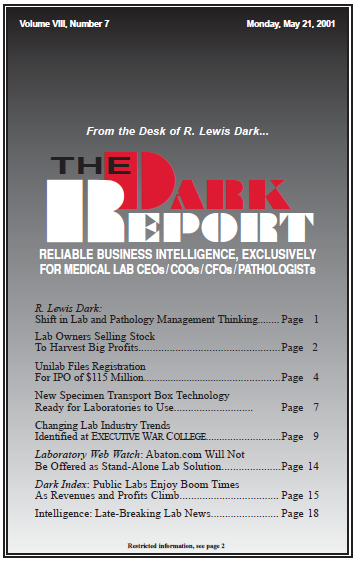

Unilab Files Registration For IPO of $115 Million Read More »

To access this post, you must purchase The Dark Report.