TAKEN COLLECTIVELY, second quarter earnings reports by public lab and pathology companies send a strong message: the lab industry is in the midst of a revenue and profit boom. It’s been more than a decade since every public lab and pathology company reported strong growth in both revenues and operating profits. This is an important …

Public Labs Enjoy Boom Times As Revenues & Profits Climb Read More »

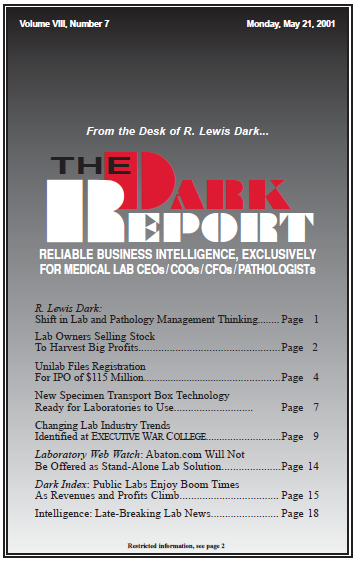

To access this post, you must purchase The Dark Report.