THIS WEEK, Quest Diagnostics Incorporated will issue its fourth quarter and full year 2012 financial report. In anticipation of this, the nation’s largest lab company has been cleaning out its closets, so to speak. With its new CEO finishing out his first eight months of service, Quest Diagnostics is taking the opportunity to dispose of …

Quest Sells OralDNA, HemoCue To Clear Its Decks for 2013 Read More »

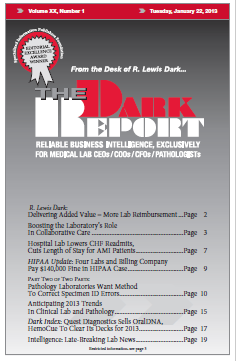

To access this post, you must purchase The Dark Report.