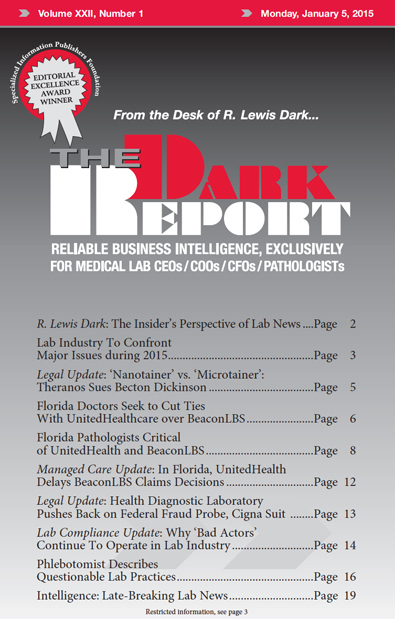

CEO SUMMARY: Will 2015 turn out to be a watershed year for the clinical laboratory industry? Not only are two federal agencies pushing forward with initiatives that will touch nearly every medical lab in the United States in the next 12 months, but other equally powerful trends continue to negatively influence the prices labs are paid for their testing services. All these factors make it essential for lab administrators and pathologist business leaders to work proactively to maintain their lab’s financial stability.

To access this post, you must purchase The Dark Report.