CEO SUMMARY: This will be one of the most challenging years facing the clinical lab industry since the early 1990s. The CMS scheme to collect private payer lab test prices and use that data to set Medicare clinical laboratory test prices is proving to be an indiscriminate tool that is poised to undermine the financial integrity of many labs, …

Is There a Future for Hospital Lab Outreach Programs? Read More »

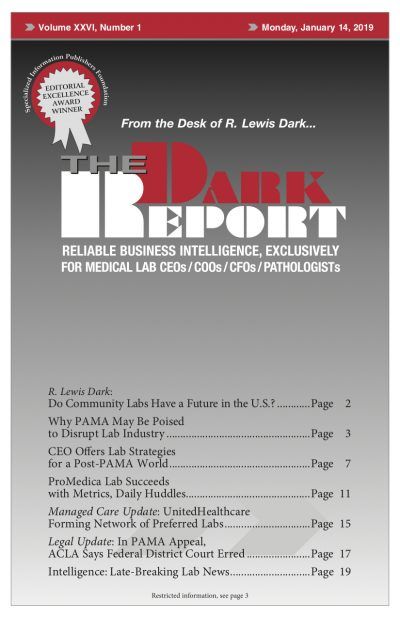

To access this post, you must purchase The Dark Report.