CEO SUMMARY: With so many market forces working against the economic interests of clinical laboratories, it is essential that all labs develop appropriate strategies designed to sustain the quality of laboratory testing services and the financial integrity of the laboratory organization. In this intelligence briefing, XIFIN, Inc.’s CEO, Lâle White, explains five strategies that are …

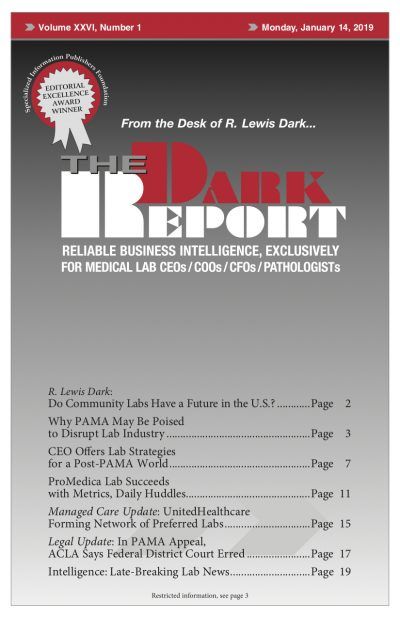

CEO Offers Lab Strategies for a Post-PAMA World Read More »

To access this post, you must purchase The Dark Report.