Laboratory Management

Laboratory management in today’s clinical lab industry is changing rapidly and facing entirely new challenges. One problem is the lack of upcoming younger lab managers, as the retirements of baby boomer pathologists, medical technologists and lab scientists are in the near future. These individuals make up the largest proportion of supervisors, managers, and lab administrators working in labs today.

As they retire, every clinical lab and pathology group needs to have the next generation of leaders ready to step up and assume responsibilities. But, across the lab industry, there are limited opportunities for every lab’s brightest up-and-comers to get the regular management development opportunities that are common among Fortune 500 companies. The Dark Intelligence Group has called for the establishment of a mentoring program to help overcome this problem.

At the same time, downward pressure on reimbursements and mounting competition have created an environment that requires much more effort for a medical lab to grow and thrive.

Legislation, including the Health Information Technology for Economic and Clinical Health Act (HITECH) of 2009 and the Patient Protection and Affordable Care Act (PPACA) of 2010, have placed significant demands on medical laboratories and healthcare providers to improve internal efficiency even while offering more services for less money. This pressure to “do more with less” is further compounded by the need to deliver increasingly personalized client service to retain and win clients.

With the era of fee-for-service medicine coming to a close, every clinical laboratory and anatomic pathology organization needs a strategy for getting paid, as new reimbursement models that support patient-centric care will make up a larger portion of lab revenues.

The challenge for every clinical laboratory manager is to understand how to evolve from a business model that is accession-centric or volume-centric to one that is patient-centric.

Many clinical laboratories today are developing data repositories to logically link all transactional and other information about a patient. These repositories allow physicians to see all relevant information, identify trends, and provide better care as a result, enabling labs to provide greater value to their customers, patients and payers, thus creating more value and becoming more patient-centric.

Specialty Labs Prepares For Public Stock Offering

By Robert Michel | From the Volume IX No. 11 – August 5, 2002 Issue

CEO SUMMARY: Stock prices for public lab companies zoomed upwards through 2000. For this reason, executives at Specialty Laboratories, Inc. believe it is an auspicious time for their laboratory to bring an initial public offering (IPO) to market. Company officials recently filed a stock r…

Successful Specialty IPO Can Open Door for Others

By Robert Michel | From the Volume IX No. 11 – August 5, 2002 Issue

CEO SUMMARY: It’s no secret that a handful of laboratory companies would like to complete an initial public offering (IPO). If Specialty Labs’ public offering goes well, expect these lab companies to bring their own stock offerings to the public equity markets. As the number of public…

National Esoteric/Reference Rankings

By Robert Michel | From the Volume IX No. 11 – August 5, 2002 Issue

Little is known about how the marketplace for hospital send-out testing is divided among national laboratory competitors.These rankings mark the second year THE DARK REPORT has attempted to measure the market for hospital esoteric and reference testing. This ranking does not include niche…

Piper Jaffray Illustrates “New” Paradigm for Role of Lab Tests

By Robert Michel | From the Volume IX No. 11 – August 5, 2002 Issue

WHEN FINANCIAL ANALYST William B. Bonello issued his overview report on the diagnostic services industry last week, little did he know that one element of his report would prove an instant hit with lab industry executives. During the U.S. Bancorp Piper Jaffray conference la…

Is it Early-90s “Deja Vu” For Today’s Lab Industry?

By Robert Michel | From the Volume IX No. 11 – August 5, 2002 Issue

CEO SUMMARY: Stock prices for laboratory and pathology companies have skyrocketed since the new decade of the 2000s dawned on January 1. Is investor optimism warranted by the opportunities ahead in diagnostic testing? Or will history repeat itself if the continuing evolution of American h…

Quest Diagnostics Emphasizes Venture Capital Investments

By Robert Michel | From the Volume IX No. 11 – August 5, 2002 Issue

ONE SIGNIFICANT business strategy in play at Quest Diagnostics Incorporated is venture capital investing. With $3 billion in sales, Quest Diagnostics is the largest clinical laboratory company in the United States. It understands that the traditional lab sales strategy of marketing …

Omnicom Group, CareSoft, eMedicine.com, Verisign, RSA Security

By Robert Michel | From the Volume IX No. 11 – August 5, 2002 Issue

AD AGENCIES PREPARING “DIRECT TO PATIENT” MARKETING CAMPAIGNS HERE’S MORE EVIDENCE that healthcare providers like laboratories and pathology groups will increasingly market their services directly to consumers. One of the largest consolidated advertising agencies in the world has take…

Genesis Clinical Laboratory Hits Outreach Home Run

By Robert Michel | From the Volume IX No. 11 – August 5, 2002 Issue

CEO SUMMARY: Commercial laboratory consolidation has left Chicago with only a handful of laboratory providers. New management at MacNeal Hospital’s for-profit laboratory division recognized this opportunity. During the past three years, the outreach program was revitalized and the sales…

IMPATH, AmeriPath, LabOne, MedTox, Genomics Collaborative, PharmChem, CARESIDE, Luminex, Fisher Scientific

By Robert Michel | From the Volume IX No. 11 – August 5, 2002 Issue

EMERGING BUSINESS OPPORTUNITY IN TISSUE BANKS & CANCER DATA EVEN AS THE HEALTHCARE SYSTEM squeezes pathologist incomes in a variety of specific professional services, it opens up business opportunities in other segments of the pathology field. Researchers and pharmaceutical companies wa…

Lab Industry Attracting New Investment Dollars

By Robert Michel | From the Volume IX No. 11 – August 5, 2002 Issue

CEO SUMMARY: Professional investors with access to hundreds of millions of dollars of investment capital are closely scrutinizing the clinical laboratory industry. They are encouraged by the recent financial performance of public laboratory companies. For independent laboratory owners, th…

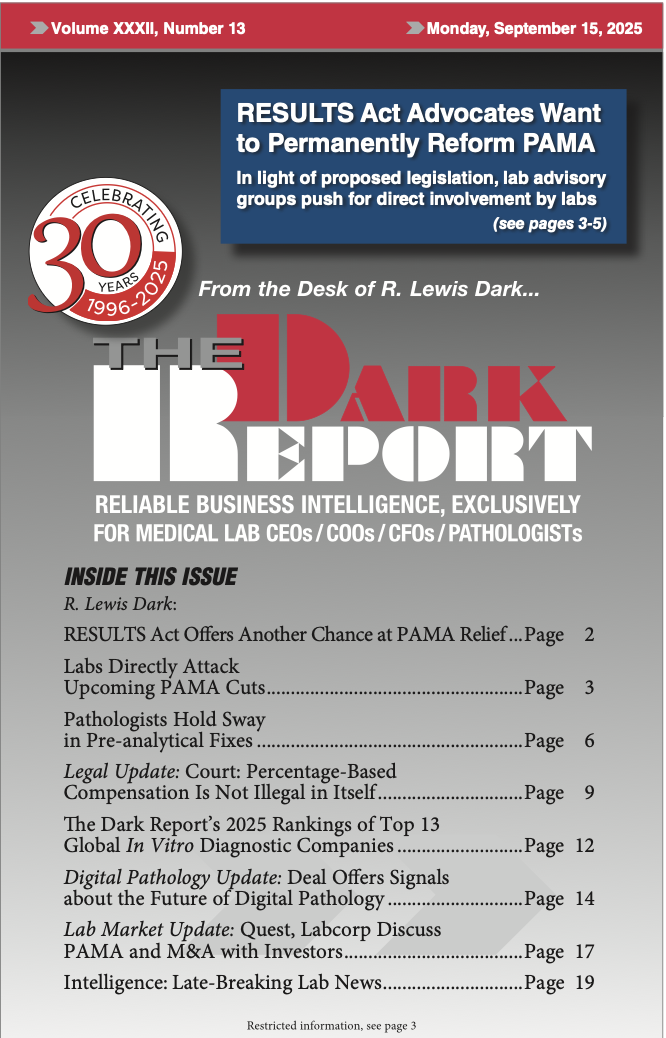

CURRENT ISSUE

Volume XXXII, No. 13 – September 15, 2025

The Dark Report examines a new bill that would reform PAMA and avoid reimbursement rate cuts scheduled for January 2026. Clinical laboratory leaders are urged to make their voices heard in Congress. Also, an expert describes how labs can fix pre-analytical errors and avoid disaster.

See the full table of contentsHow Much Laboratory Business Intelligence Have You Missed?

Lab leaders rely on THE DARK REPORT for actionable intelligence on important developments in the business of laboratory testing. Maximize the money you make-and the money you keep! Best of all, it is released every three weeks!

Sign up for TDR Insider

Join the Dark Intelligence Group FREE and get TDR Insider FREE!

Never miss a single update on the issues that matter to you and your business.

Topics

- Anatomic Pathology

- Clinical Chemistry

- Clinical Laboratory

- Clinical Laboratory Trends

- Digital Pathology

- Genetic Testing

- In Vitro Diagnostics

- IVD/Lab Informatics

- Lab Intelligence

- Lab Marketplace

- Lab Risk & Compliance

- Laboratory Automation

- Laboratory Billing

- Laboratory Compliance

- Laboratory Equipment

- Laboratory Information Systems

- Laboratory Management

- Lean Six Sigma

- Managed Care Contracts

- Molecular Diagnostics

- Pathology Trends

- People

- Uncategorized