CEO SUMMARY: Florida is about to become the marketing battleground for anatomic pathology. Three well-funded players are preparing to launch major sales efforts. Pathologists in the state wait with trepidation. Expectations of discounted pricing and a “gloves-off” sales strategy concern Florida’s hospital-based pathologists. FOR PATHOLOGISTS CONCERNED with their economic and professional future, Florida is a …

Pathology Competitors Make Florida The Target Read More »

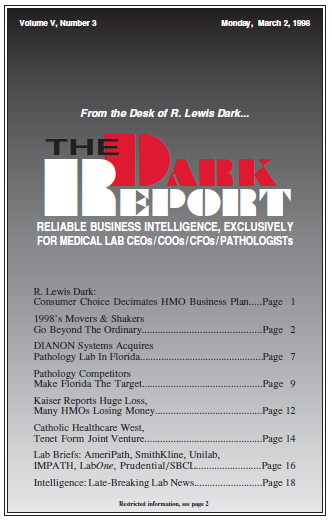

To access this post, you must purchase The Dark Report.