AMERIPATH REPORTS EARNINGS, NEW PURCHASE AmeriPath, Inc. of Riviera Beach, Florida announced its 1997 financial performance. For the year, company revenues totaled $108.4 million. On February 17, the company also disclosed the acquisition of Anatomic Pathology Associates (APA), located in Indianapolis, Indiana. AmeriPath intends to combine APA’s 14 pathologists with the 13 pathologists of CoLab, …

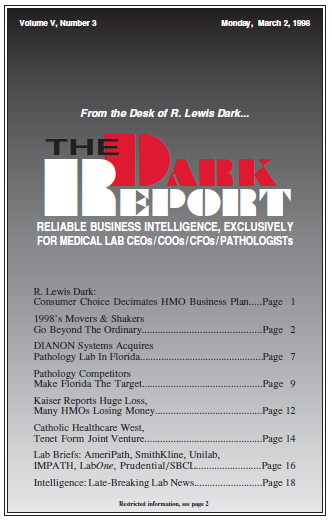

AmeriPath, SmithKline, Unilab, IMPATH, LabOne, Prudential/SBCL Read More »

To access this post, you must purchase The Dark Report.