CEO SUMMARY: More laboratory overcapacity may be removed from the California marketplace if Unilab purchases Meris Laboratories. Unilab’s offer to buy Meris must be cleared by the bankruptcy court and other bidders may surface during the coming weeks. These events are a reminder that financial pressure on the clinical laboratory industry continues to force change …

Unilab’s Bid To Buy Meris Will Shake Up California Read More »

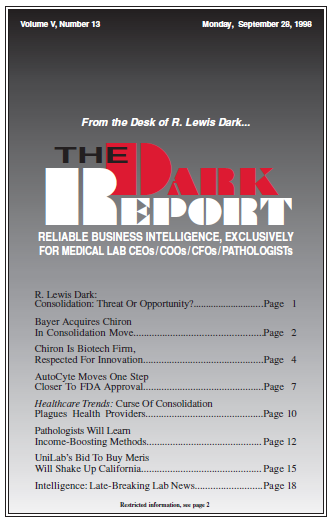

To access this post, you must purchase The Dark Report.