If analysis is to be accurate and objective, it must recognize and praise successful accomplishments while at the same time recognizing and criticizing failures. Human nature being what it is, however, criticism of failed business decisions is painful and bound to generate denials by the parties involved. One key element of a White Paper review …

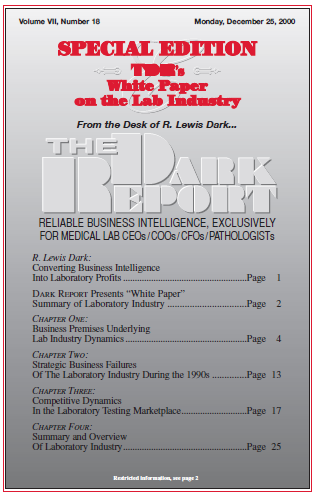

Strategic Business Failures Of The Laboratory Industry During the 1990s Read More »

To access this post, you must purchase The Dark Report.