CEO SUMMARY: Reviewing an AP practice’s expenses is vitally important today when payers are cutting reimbursement. In the past, government and private payers paid more for the technical and professional components of anatomic pathology work, but those rates have eroded. While conversations about revenue tend to obscure the need to talk about expenses, effective financial …

AP Practices Cautioned to Focus on Expenses Read More »

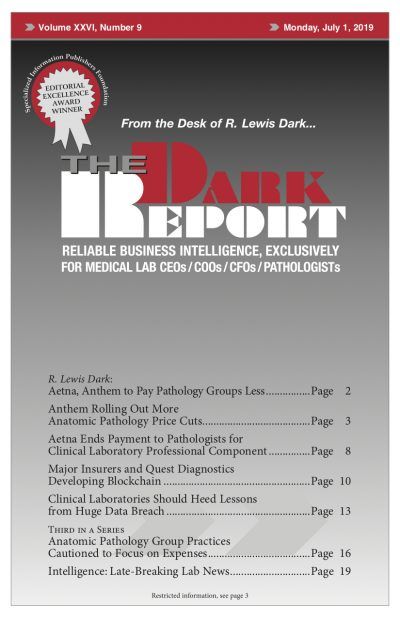

To access this post, you must purchase The Dark Report.