CEO SUMMARY: In a front-page story last Friday, the Wall Street Journal published an investigative story on the topic of client billing for laboratory testing and anatomic pathology services. It’s a “must-read” story for all pathologists and lab managers. For years, the lab industry has recognized how client-billing arrangements can encourage a variety of abuses …

WSJ Slams Client Bill For Lab Test Services Read More »

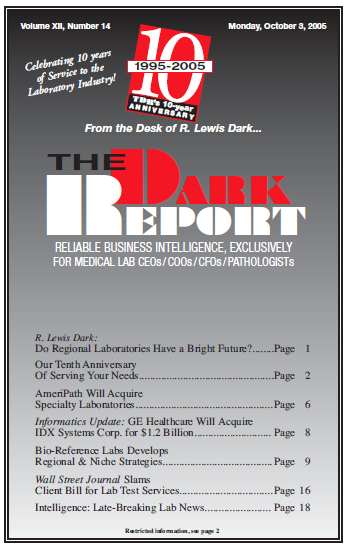

To access this post, you must purchase The Dark Report.