CEO SUMMARY: It was on September 25, 1995 that the first issue of THE DARK REPORT was published. The laboratory industry was in financial turmoil. There was widespread consolidation in both the commercial lab sector and among hospital laboratories. Reimbursement for lab testing services was falling rapidly. Yet, through all these negative changes, there were …

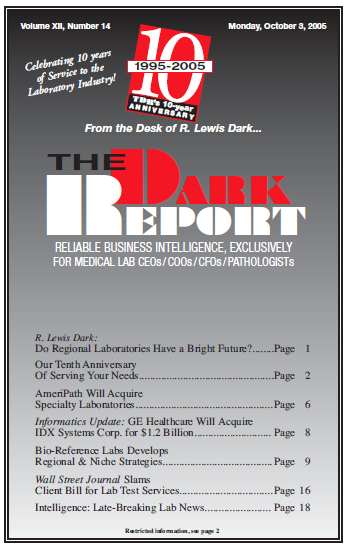

Our Tenth Anniversary Serving Your Needs Read More »

To access this post, you must purchase The Dark Report.