CEO SUMMARY: Across the United States, clinical labs, histology labs, and pathology groups are experiencing both a much longer payment cycle for claims and a decreased gross collection rate. Blame can be placed on several trends. One trend is the steady increase in the number of patients with high-deductible health plans. Another trend involves payers …

Longer Pay Cycle for Labs, Plus Lower Collection Rate Read More »

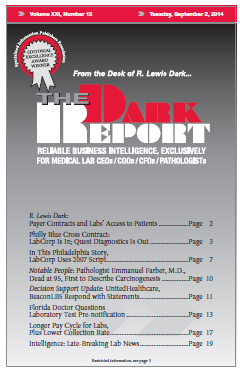

To access this post, you must purchase The Dark Report.