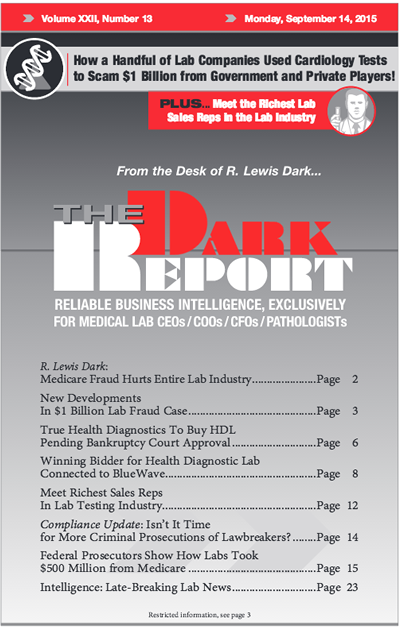

CEO SUMMARY: In this second phase of the whistleblower case against three cardiology testing labs and a sales consulting company, federal prosecutors are requesting a jury trial against the individuals named in the court documents filed August 7. Federal investigators alleged that executives at one lab began a fraud scheme in 1999 and then expanded that scheme to other labs over 15 years. The suit claims that the labs made improper payments to referring physicians.

To access this post, you must purchase The Dark Report.