IT WAS A MIXED BAG OF THIRD QUARTER FINANCIAL RESULTS for the nation’s largest in vitro diagnostics (IVD) manufacturers, with COVID-19 testing volume a contributing factor. Fluctuating demand for SARS-CoV-2 testing proved perplexing, as some IVD companies saw an increase in sales of these tests, while some IVD firms reported a nosedive in related test …

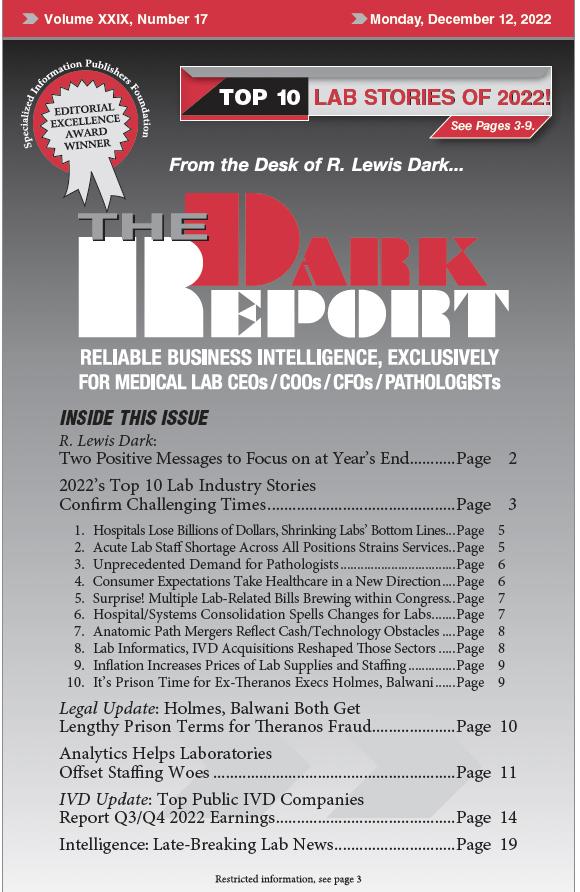

Top Public IVD Companies Report Q3/Q4 2022 Earnings Read More »

To access this post, you must purchase The Dark Report.