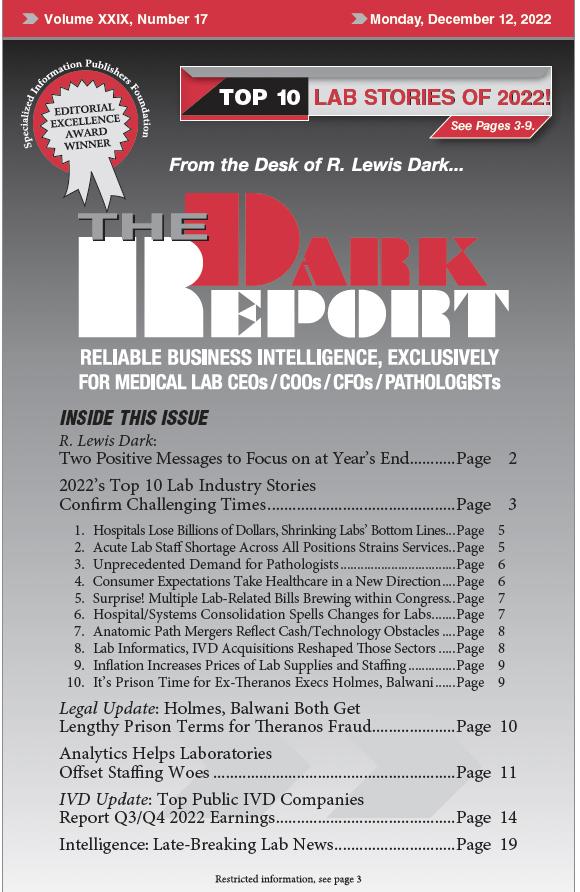

CEO SUMMARY: There are valuable insights to be gleaned from The Dark Report’s “Top 10 Lab Industry Stories for 2022.” Several of this year’s story picks involve external forces reshaping healthcare in the United States in profound ways. Other story picks for 2022 illustrate the most difficult challenges confronting clinical laboratories and anatomic pathology groups. …

2022’s Top 10 Lab Stories Confirm Challenging Times Read More »

To access this post, you must purchase The Dark Report.