EACH TIME A MAJOR IN VITRO DIAGNOSTICS (IVD) COMPANY reports its quarterly earnings, clinical lab executives and pathologists gain useful new perspectives as to how the COVID-19 pandemic is fueling demand for IVD instruments, tests, and lab consumables. In this round-up of the most recent quarterly earnings reports, we provide details about Thermo Fisher Scientific, Agilent Technologies, bioMerieux, Bio-Rad, and Sysmex Corporation. IVD …

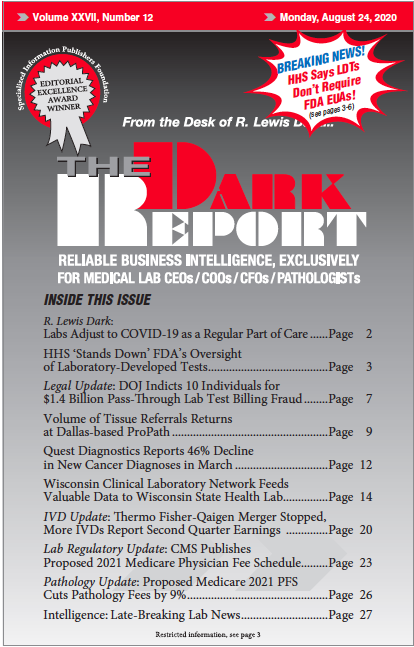

Thermo–Qaigen Merger Stopped, More IVDs Report Q2 Earnings Read More »

To access this post, you must purchase The Dark Report.