Because of the COVID-19 pandemic, second quarter earnings reports were a good news/bad news situation for most of the nation’s major in vitro diagnostic (IVD) companies. The good news was that demand for COVID-19 tests meant increased sales and revenues for IVD firms selling those products. But the collapse in routine lab testing that happened in March, April, May, and June was bad news …

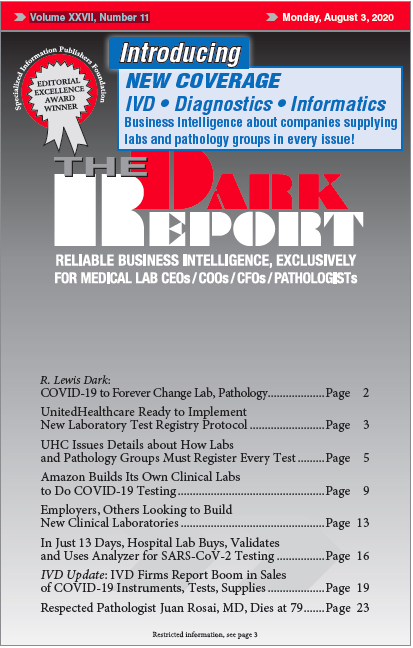

IVD Firms Report Boom in Sales of COVID-19 Instruments, Tests Read More »

To access this post, you must purchase The Dark Report.