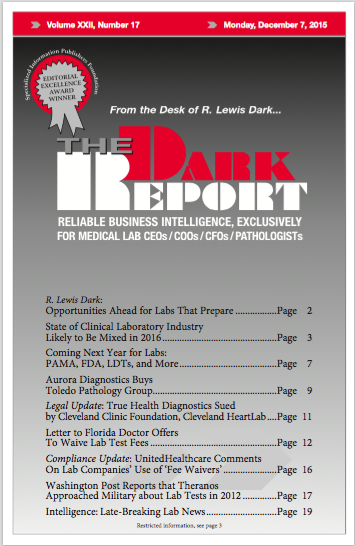

CEO SUMMARY: Over the next 24 months, it will be essential for every clinical laboratory and anatomic pathology group to develop clinical and financial strategies that meet the changing needs of health insurers, hospitals and health systems, physicians, and patients. THE DARK REPORT provides its assessment of key macro trends for 2016, along with comments …

State of Clinical Lab Industry Likely to Be Mixed in 2016 Read More »

To access this post, you must purchase The Dark Report.