IN REPORTING SECOND QUARTER EARNINGS, there was enough difference in the numbers announced by Quest Diagnostics Incorporated and Laboratory Corporation of America to catch the attention of financial analysts. Revenue at LabCorp was up for the quarter while revenue at Quest Diagnostics was down for the quarter. But the devil is in the details. Financial …

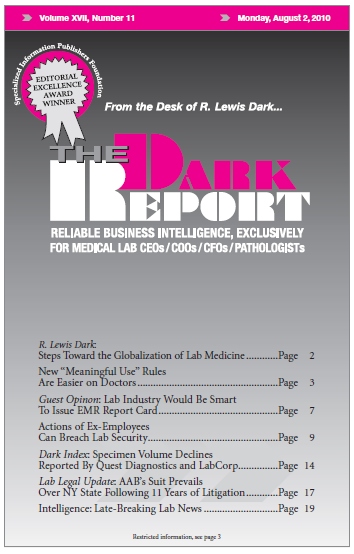

Specimen Volume Declines Reported By Quest Diagnostics and LabCorp Read More »

To access this post, you must purchase The Dark Report.