CEO SUMMARY: THE DARK REPORT offers its pick of the “Ten Biggest Lab Stories of 2005.” This year’s list of stories ranges from major consolidation in both the laboratory and health insurance industries, to “true crime” episodes that triggered criminal indictments of certain public lab executives. 2005’s most important story may be the forceful arrival of consumer-directed health …

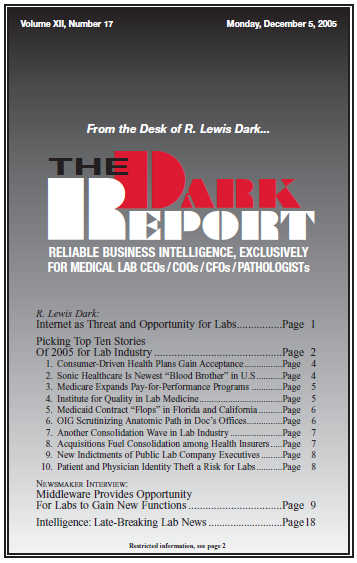

Picking Top Ten Stories Of 2005 for Lab Industry Read More »

To access this post, you must purchase The Dark Report.