IN RECENT WEEKS, the last of the nation’s largest public laboratory companies released year-end 2009 financial reports. Each lab firm’s financial report provides useful insights about active trends in the lab testing marketplace, particularly in lab testing referred by office-based physicians. Quest Diagnostics Incorporated and Laboratory Corporation of America are the two dominant national companies …

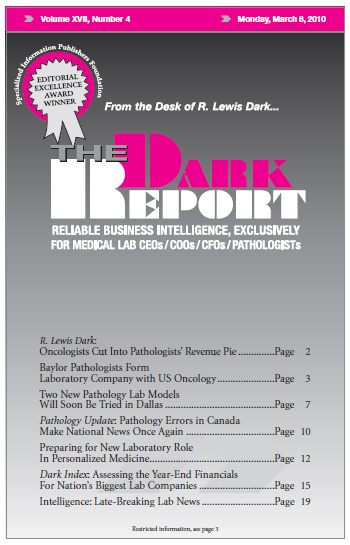

Assessing the Year-End Financials For Nation’s Biggest Lab Companies Read More »

To access this post, you must purchase The Dark Report.