CEO SUMMARY: Owners of the few remaining independent private laboratory companies closely watch prices paid by lab buyers. In the pending sale of AmeriPath to private equity investor Welsh, Carson, Anderson, & Stowe, dissenting shareholders disclosed several aspects of the valuation process. This information provides useful insights into the process of valuing laboratory companies. DISSENTING …

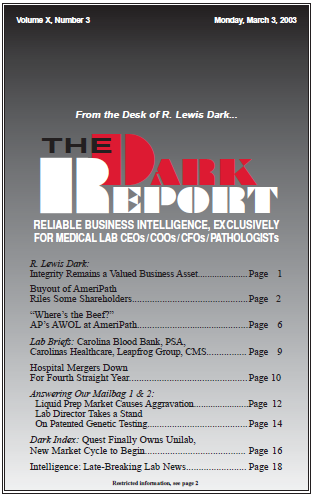

Buyout of AmeriPath Riles Some Shareholders Read More »

To access this post, you must purchase The Dark Report.