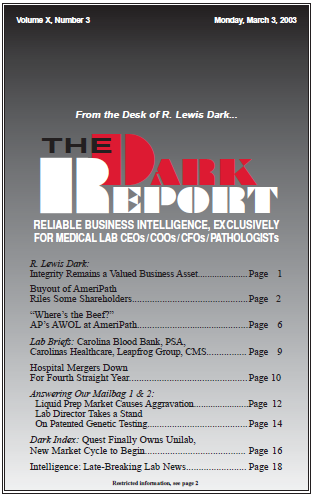

CEO SUMMARY: Changes in hospital ownership often drive laboratory restructuring projects. But hospital merger and acquisition activity has declined for four consecutive years. Consequently, comprehensive laboratory restructuring efforts have declined in parallel. Hospital M&A numbers for 2003 are predicted to remain at a low level. Meanwhile, cross-system laboratory ventures seem to be also languishing. FOR …

Hospital Mergers Down For Fourth Straight Year Read More »

To access this post, you must purchase The Dark Report.