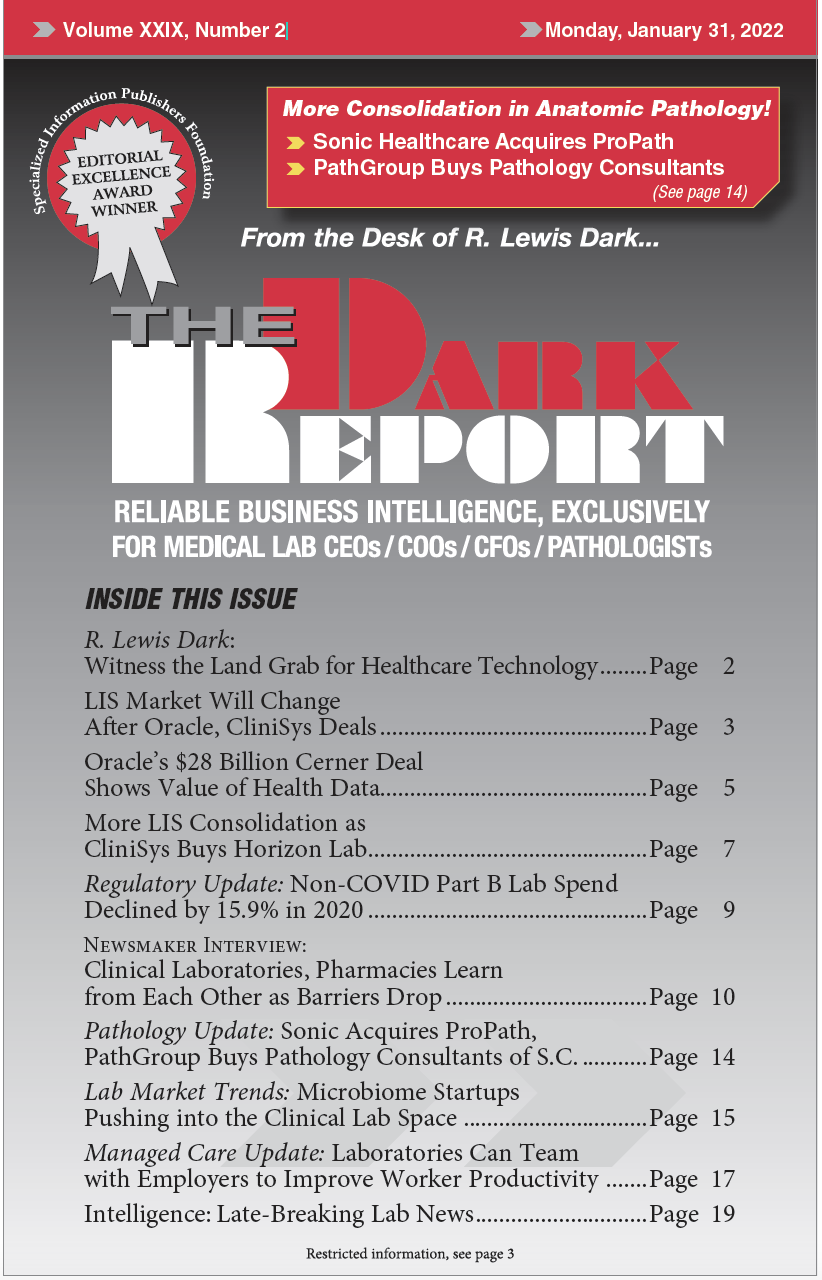

This is an excerpt of a 843-word article in the January 31, 2022 issue of THE DARK REPORT (TDR). The full article is available to members of The Dark Intelligence Group. CEO SUMMARY: The Oracle and CliniSys acquisitions will create major changes. With its purchase of Cerner Corporation, Oracle becomes the owner of Cerner’s Millennium […]

To access this post, you must purchase The Dark Report.