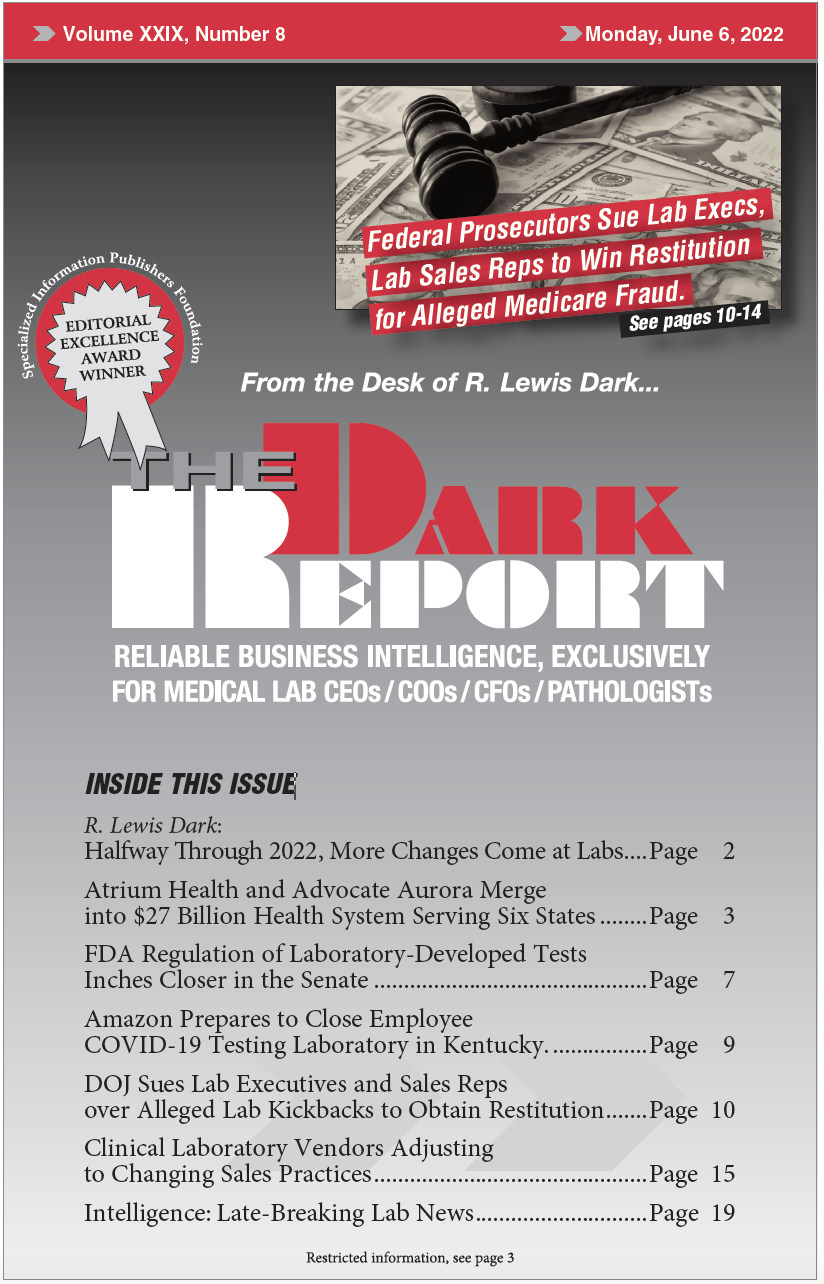

CEO SUMMARY: Multiple executives and sales representatives at True Health Diagnostics and Boston Heart Diagnostics have been named as defendants in a civil suit filed by the U.S. Department of Justice. The complaint centers on alleged kickbacks in return for clinical laboratory test referrals. The companies and employees involved have been associated with allegations, a …

DOJ Charges Execs over Alleged Lab Kickbacks to Obtain Restitution Read More »

To access this post, you must purchase The Dark Report.