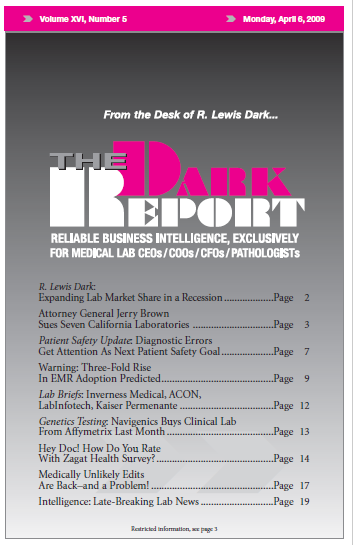

CEO SUMMARY: California Attorney General Jerry Brown made a big splash last month by accusing seven lab firms of committing “massive fraud and kickbacks” under state Medicaid laws. However, he is relying on a legal theory that has not prevailed in some prior court cases involving discounted billing for laboratory testing. Nonetheless, it appears that …

Attorney General Brown Sues Seven California Labs Read More »

To access this post, you must purchase The Dark Report.