IT’S GOING TO BE A DIFFERENT AND TOUGHER WORLD for laboratory companies that market proprietary molecular and genetic tests. That’s the opinion of experts who have studied the final rule governing Advanced Diagnostic Laboratory Tests (ADLTs) that the federal Centers for Medicare & Medicaid Services issued in June. The final rule implements Section 216 of …

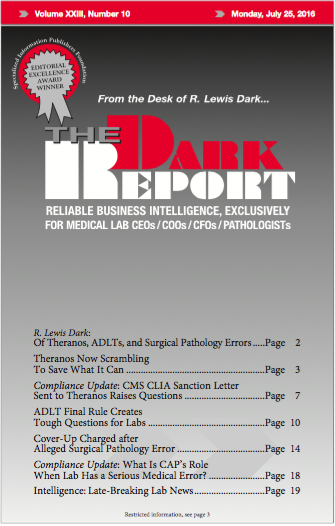

ADLT Final Rule Creates Tough Questions for Labs Read More »

To access this post, you must purchase The Dark Report.