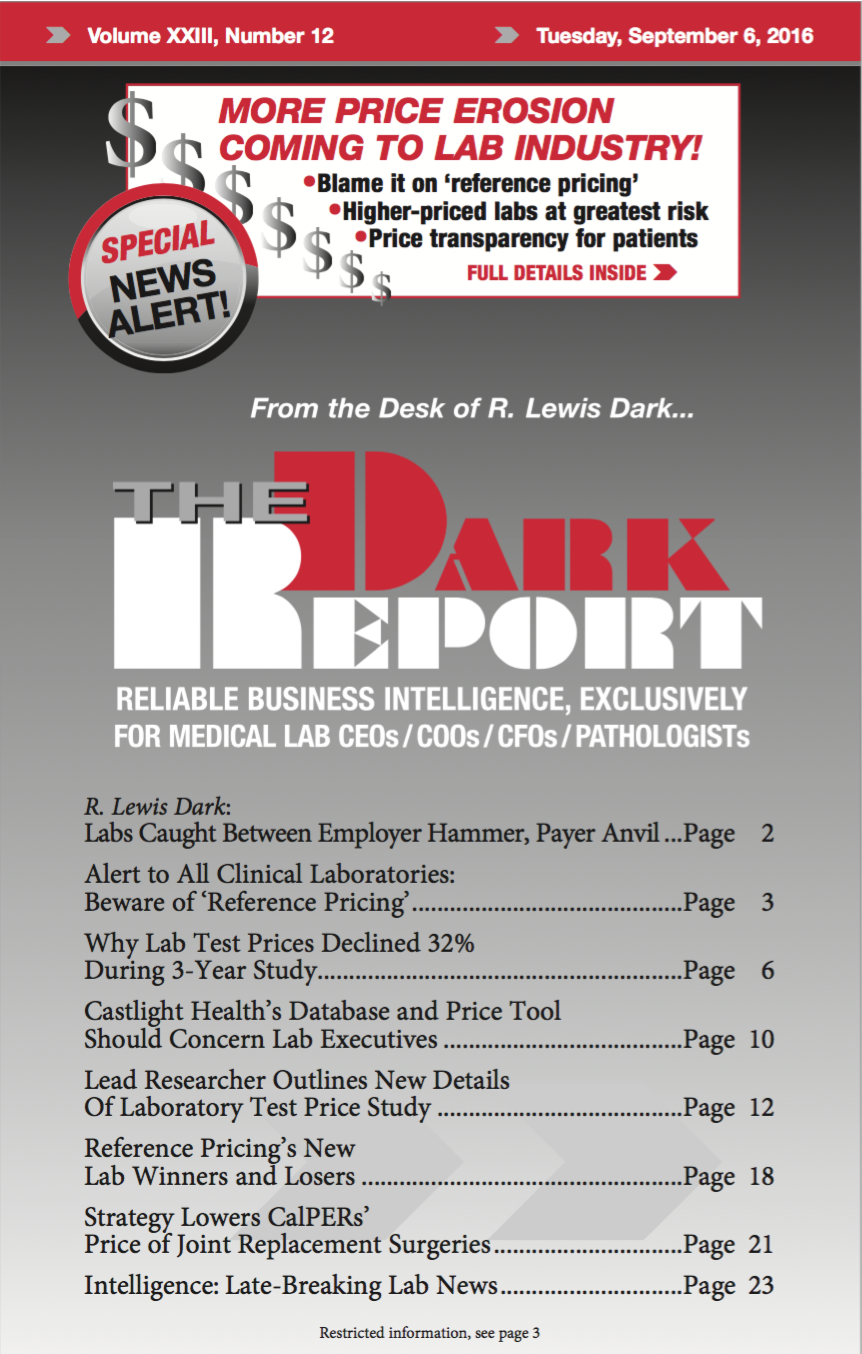

CEO SUMMARY: Expanded use of reference pricing by employers in coming years could trigger a cycle of cuts to lab test prices that would put the most pressure on the lab companies with the highest prices. Many hospital labs are viewed as having high prices. But because they run outreach specimens in the evenings and …

Reference Pricing’s New Lab Winners and Losers Read More »

To access this post, you must purchase The Dark Report.