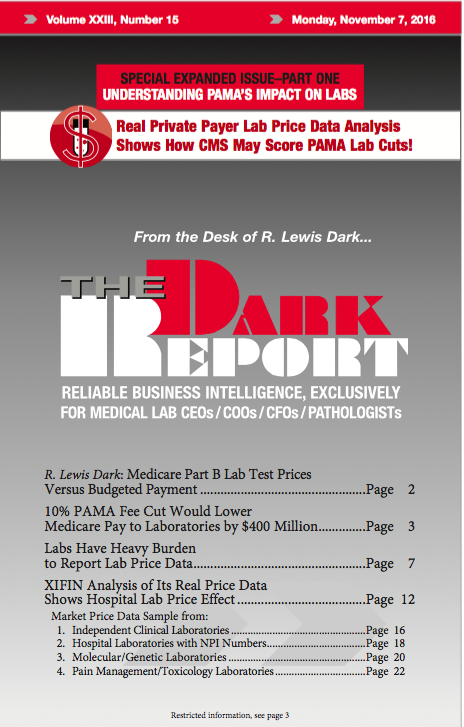

CEO SUMMARY: Clinical labs must assess their responsibilities to report lab test market prices to CMS as part of the Protecting Access to Medicare Act. A panel of three experts took up this topic at a recent webinar hosted by THE DARK REPORT. On June 23, the federal Centers for Medicaid & Medicare Services published …

Labs Have Heavy Burden to Report Lab Price Data Read More »

To access this post, you must purchase The Dark Report.