FORWARD-LOOKING PATHOLOGISTS AND LAB ADMINISTRATORS understand that the next big game in medical laboratory testing will be assays built upon genome sequencing. They also know that several companies are racing to produce gene sequencing instruments that are faster, simpler, and less costly in order to serve the needs of clinical labs. Currently, Illumina, Inc., of …

PacBio Beefs Up with Purchase of Omniome for $800 Million Read More »

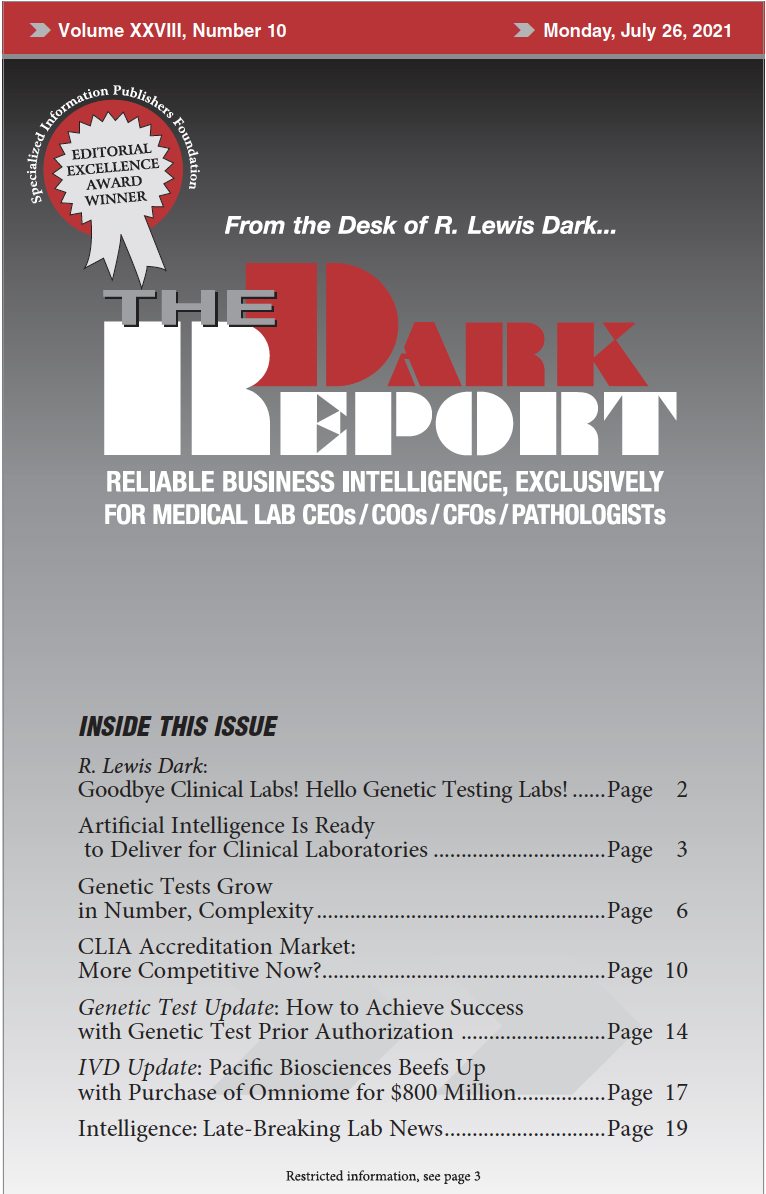

To access this post, you must purchase The Dark Report.