CEO SUMMARY: It may be the first time that a former public laboratory CEO has turned whistleblower. Andrew Baker, formerly Chairman and CEO of Unilab Corporation in the 1990s, filed a qui tam case in federal court last year that centers on the practice of lab companies offering private health plans deeply-discounted lab test pricing …

Former Lab CEO Explains Why He Filed Lawsuit Read More »

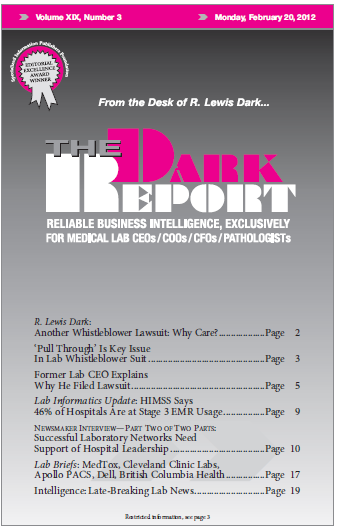

To access this post, you must purchase The Dark Report.