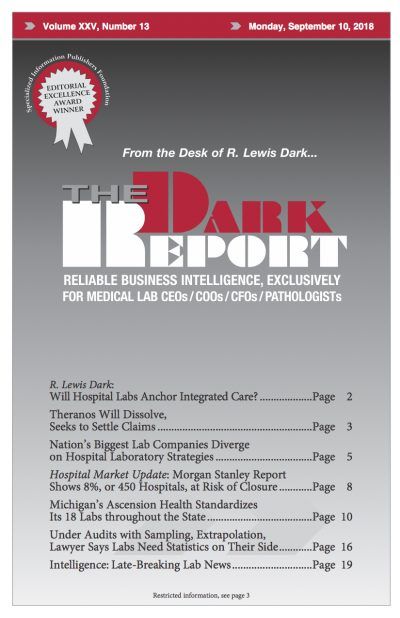

AMONG THE ROUGHLY 6,500 HOSPITALS OPERATING in the United States, only about 125 (2.5%) have closed in the past five years. But in the coming years, some 450 hospitals are at risk of closing. Analysts at Morgan Stanley said 600 other hospitals have weak finances that could lead them to close. In the report, Morgan …

Morgan Stanley Report Shows 8% of Hospitals at Risk of Closure Read More »

To access this post, you must purchase The Dark Report.