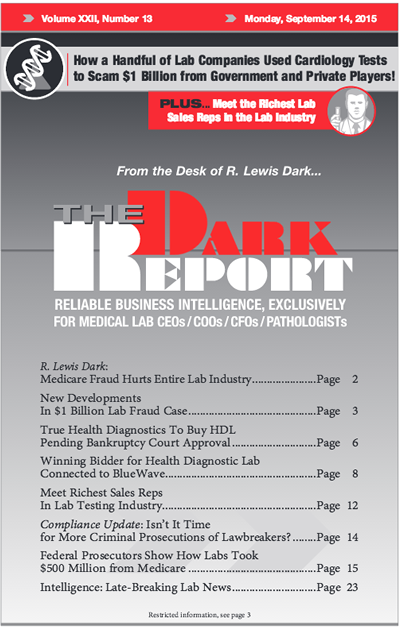

IT’S THE $1 BILLION LABORATORY FRAUD that no one realized had grown so big. In this special issue of THE DARK REPORT, you’ll read how the next chapter of the federal whistleblower lawsuit against three specialty cardiology labs and certain individuals has pulled the curtain open on what we believe is the biggest case of laboratory fraud and abuse in the past 30 years. Court documents […]

To access this post, you must purchase The Dark Report.