CEO SUMMARY: Despite much success and milestones at Specialty Laboratories during the past 36 months, it has yet to achieve the most important goal of all: net profits. One reason is familiar to all laboratory administrators and pathologists: with its existing fixed overhead and cost structure, Specialty Labs’ key goal is to increase specimen volume …

Profit Squeeze Pressures Specialty Laboratories Read More »

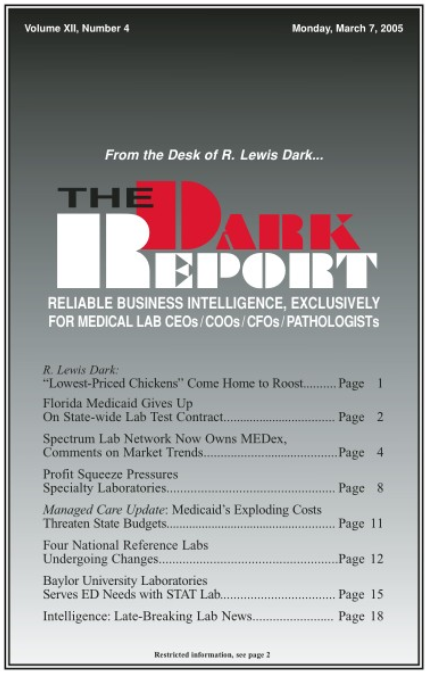

To access this post, you must purchase The Dark Report.