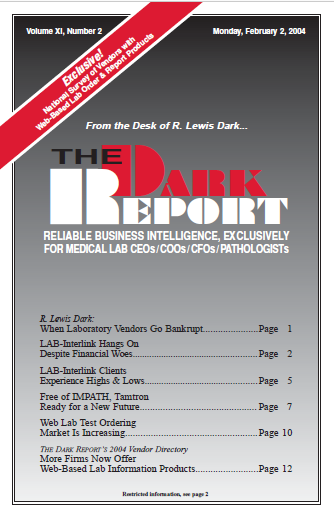

CEO SUMMARY: In recent years, the market for browser-based laboratory test ordering and results reporting systems has grown at a steady rate. Second and third generation products are more robust, offer more features, and are easier to install and operate. To date, smaller start-up companies are capturing more sales than the big healthcare IT corporations, …

Web Lab Test Ordering Market Is Increasing Read More »

To access this post, you must purchase The Dark Report.